SmartFunds was designed to provide attractive financing for borrowers qualifying with assets only. It features loans up to $3M, with no employment, income or tax documentation required!

HIGHLIGHTS:

HIGHLIGHTS:

- Net residual assets > 60 months of total monthly obligations + reserves

- LTVs up to 90% for Purchase & Rate/Term and up to 85% Cash Out – No MI

- Primary residences and second homes (no NOO)

- Borrower can own up to 15 financed properties

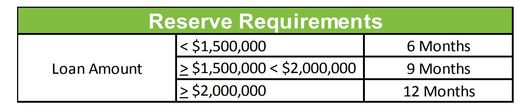

- Reserves waivable on Rate/Term with the <$1.5M loan amount, 0x30x12, and decreasing housing payment

- No pre-payment penalty

- No DTI calculation

- 30-year fixed and 10/1, 7/1, 5/1 ARMs – all with optional Interest Only

HERE'S HOW IT WORKS:

Simply put, we add up all their eligible assets and subtract the entire loan amount and closing costs. Then we compare that to their total monthly obligations over 5 years plus reserve requirements. If qualifying assets are greater than their total obligations and reserves, they qualify.

See example on the right. Refer to guidelines to determine which assets may be used and to what extent.

Ineligible Borrowers:

Eligible Property Types include:

Ineligible Properties:

Acreage greater than 20 acres (appraisal must include total acreage) • Properties used for Agricultural purposes • Commercial Enterprises (e.g. Bed and Breakfast, Boarding House, Hotel) • Condotels • Co-ops • Geodesic Domes, Berms, Earth homes • Hobby Farms • Income producing properties with acreage • Leaseholds • Log homes • Manufactured/Mobile, Modular, or Factory Built Homes • Projects with insufficient Flood Insurance – Borrower supplemented is not permitted • Properties appraised with a property condition of C5 or worse • Properties held in a business name • Properties located adjacent to or containing environmental hazards • Properties Purchased Through Auctions • Properties subject to oil and/or gas leases (may be eligible on a case-by-case basis) • Properties vested in an LLC or Corporation (title must be taken as an individual) • Properties with less than 750 square feet of living area • Timeshares • Unimproved Land and property currently in litigation • Unique properties • Working farms, ranches or orchards • Zoning violations including residential properties zoned commercial

Income & Employment:

Employment and income is not disclosed on the 1003 and is not documented. A signed 4506T and/or tax transcripts are not required.

Asset Qualification:

The Smart Funds Qualification product allows eligible assets to be used in the determination of the Ability to Repay (ATR) by performing a loan qualification calculation and a residual income calculation. A minimum of $500,000 “net assets” as defined below is required Assets covering the following must be verified:

Requirements:

Eligible Asset Types:

Ineligible Asset Types:

Loan Qualification Calculation Steps:

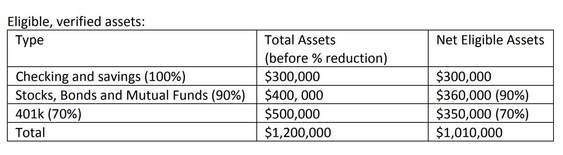

1. Determine the net eligible assets. The loan qualification calculation uses net eligible assets, which are defined as eligible assets minus:

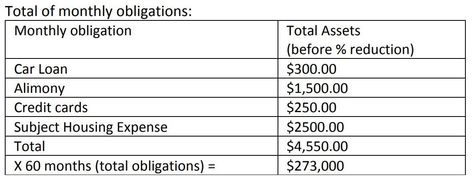

2. The total of the monthly obligations is then multiplied by 60 months. Monthly debt obligations include:

3. Add any required reserves to the result of the total monthly obligations multiplied by 60 months. Subject property reserves use P&I only, while all other real estate owned reserves use PITIA.

4. If the net eligible assets are at least $500,000 AND more than the total of the monthly obligations multiplied by 60 months plus reserves, the loan qualifies. Example: Loan amount: $450,000 Down payment, closing costs and prepaids: $50,000 Principal and interest (P&I): $2,500

- Borrowers whose qualifying assets are not sufficient to meet 60 months or more of obligations.

- Borrowers with any ownership in a business that is federally illegal, regardless if the income is not being considered for qualifying

- Borrowers with diplomatic immunity or otherwise excluded from U.S. jurisdiction

- Foreign Nationals

- Land Trusts

- Non-Permanent Resident Aliens

- Permanent Resident Aliens

- Non-occupant co-borrowers

- Properties vested in an LLC or Corporation (title must be taken as an individual)

Eligible Property Types include:

- One-unit Attached/Detached SFRs

- One-unit Attached/Detached PUDs

- Low/Mid/High-Rise Condos and Site Condos

- 2-4 Unit Properties

Ineligible Properties:

Acreage greater than 20 acres (appraisal must include total acreage) • Properties used for Agricultural purposes • Commercial Enterprises (e.g. Bed and Breakfast, Boarding House, Hotel) • Condotels • Co-ops • Geodesic Domes, Berms, Earth homes • Hobby Farms • Income producing properties with acreage • Leaseholds • Log homes • Manufactured/Mobile, Modular, or Factory Built Homes • Projects with insufficient Flood Insurance – Borrower supplemented is not permitted • Properties appraised with a property condition of C5 or worse • Properties held in a business name • Properties located adjacent to or containing environmental hazards • Properties Purchased Through Auctions • Properties subject to oil and/or gas leases (may be eligible on a case-by-case basis) • Properties vested in an LLC or Corporation (title must be taken as an individual) • Properties with less than 750 square feet of living area • Timeshares • Unimproved Land and property currently in litigation • Unique properties • Working farms, ranches or orchards • Zoning violations including residential properties zoned commercial

Income & Employment:

Employment and income is not disclosed on the 1003 and is not documented. A signed 4506T and/or tax transcripts are not required.

Asset Qualification:

The Smart Funds Qualification product allows eligible assets to be used in the determination of the Ability to Repay (ATR) by performing a loan qualification calculation and a residual income calculation. A minimum of $500,000 “net assets” as defined below is required Assets covering the following must be verified:

- the loan amount requested

- all monthly debt obligations (as noted below), covering a period of no less than 60 months

- reserve requirements

Requirements:

- Assets used for the loan qualification calculation must be verified as being seasoned for the most recent twelve (12) months.

- Monthly or quarterly bank statements are required covering the most recent twelve (12) months. • The ending balance of the last statement is the amount that will be used in the calculation.

- Statements should be evaluated month over month for consistency to demonstrate the borrower(s) ability to maintain the asset level needed for qualification.

- Increases or decreases greater than 15% on a month to month basis over the twelve (12) month period may require additional explanation and documentation.

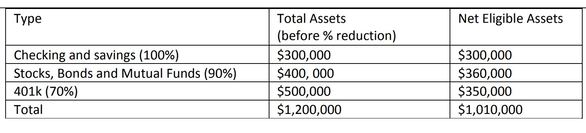

Eligible Asset Types:

- Checking, Savings, Money Market accounts (UTMA/Custodial Accounts not permitted)

- Stocks, Bonds or Mutual Funds that are not in a retirement account (publicly traded) (use 90% of value)

- Retirement accounts (use 70% of value) (Borrower must be age 59 ½ or older. ot eligible if regular distributions have already been set up)

Ineligible Asset Types:

- Business funds

- Life insurance including face value

- Stock and bonds that are not publicly traded

- Stock options or RSUs

- Annuities of any kind

- Assets that are not liquid such as but not limited to collectables, autos, etc.

- Assets held as cryptocurrency even if converted

- Funds held in foreign accounts or investments

- Gift funds

Loan Qualification Calculation Steps:

1. Determine the net eligible assets. The loan qualification calculation uses net eligible assets, which are defined as eligible assets minus:

- Any debt tied to the asset (e.g. margin account, 401k loan)

- The new loan amount on the subject property

- Down payment, closing costs and prepaid items

- Required reserves

- 30-day account balance (liquid assets must be documented)

2. The total of the monthly obligations is then multiplied by 60 months. Monthly debt obligations include:

- Subject property expenses including the monthly payment on the mortgage transaction, property taxes, hazard and/or flood insurance, HOA dues and any other leasehold, subordinate financing, etc. The monthly payment on the mortgage transaction must be calculated using the fully indexed rate or any introductory interest rate, whichever is greater; and using monthly, fully amortizing payments that are substantially equal. Installment debt with 10 months or more remaining

- Revolving debt

- Alimony, child support or maintenance payments with 10 months or more remaining

- Auto Lease payments

- Student loans, including deferred or in forbearance, with 10 months or more remaining

- Negative rental income (Refer to Section 5.4 Rental Income)

3. Add any required reserves to the result of the total monthly obligations multiplied by 60 months. Subject property reserves use P&I only, while all other real estate owned reserves use PITIA.

4. If the net eligible assets are at least $500,000 AND more than the total of the monthly obligations multiplied by 60 months plus reserves, the loan qualifies. Example: Loan amount: $450,000 Down payment, closing costs and prepaids: $50,000 Principal and interest (P&I): $2,500

$1,010,000 net eligible assets

- $450,000 loan amount

- $50,000 DP, CC and PP

= $510,000 residual assets

Required reserves = $2,500 P&I x 3 months = $7,500.

Total obligations of $273,000 plus reserves of $7,500 = $280,500.

Borrower qualifies since residual assets of $510,000 are more than $280,500 total obligations

Total obligations of $273,000 plus reserves of $7,500 = $280,500.

Borrower qualifies since residual assets of $510,000 are more than $280,500 total obligations

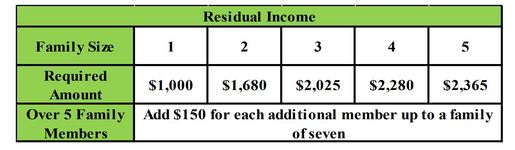

Residual Income (Disposable Income):

Residual income requirements must be met, and is calculated as follows:

Total monthly income – total monthly obligations (expenses) = monthly residual income

Total monthly income = total allowable assets / 60 months

Example: Loan amount: $450,000 Principal and interest (P&I): $2,500

$1,010,000 (net eligible assets) / 60 months = $16,833.33 (total monthly income)

Total monthly debt obligations as determined in Section 5.2 = $4,550.00

$16,833.33 (total monthly income) minus $4,550.00 (total monthly obligations) = $12,283.33 monthly residual income

Monthly residual income must meet the following requirements:

Total monthly debt obligations as determined in Section 5.2 = $4,550.00

$16,833.33 (total monthly income) minus $4,550.00 (total monthly obligations) = $12,283.33 monthly residual income

Monthly residual income must meet the following requirements:

Assets:

- Borrowers must have sufficient liquid assets for down payment, closing costs, and reserves. They must be sourced using the most recent two (2) months’ statements or the most recent quarterly statement.

- Full Asset Documentation is required for both funds to close and reserves in accordance unless specifically noted herein.

- Verification of Deposit are not permitted to be used in lieu of bank/financial statements

- If the latest financial institution records are more than 45 days earlier than the date of the loan application, the borrower must provide a more recent, supplemental or bank generated form that shows the account number, balance and date.

- The records may be computer generated forms including online account or portfolio records downloaded from the Internet. Documents that are faxed to the lender or downloaded from the internet must clearly identify the name of the depository or investment institution and the source of the information – for example, by including that information in the internet or fax banner at the top of the document

- Large disparities between the current balance and the opening balances may require additional verification or documentation.

- Large or irregular deposits must be explained and documented. Large deposits are deposits greater than 15% of the month to month balance o Large deposits should be evaluated to ensure they are not a result of any new undisclosed debt(s)

Down payment:

n purchase transactions, the Borrower must make a minimum down payment with funds from his/her own resources. All funds for down-payment must be the Borrower’s own funds. The amount of the minimum required down payment depends upon the occupancy of the subject property, documentation type and loan program.

Reserves:

Reserves are based on the monthly housing expense for a property. The required number of months of reserves is dependent on factors such as, but not limited to, the occupancy, loan purpose, type of property, and loan amount. The monthly housing expense for purposes of determining reserves is principal and interest (P&I). NOTE: Certain assets are discounted when used for reserves. Refer to the applicable asset type for additional information.

Acceptable Assets:

Checking & Savings:

- 100% of the funds held in a checking or savings account may be used for the down payment, closing costs, financial reserves or net eligible assets to determine the total monthly debt calculation

- Any indications of borrowed funds must be investigated. They include recently opened accounts, recent large deposits, or account balances that are considerably greater than the average balance over the previous few months.

- A written explanation of the source of funds from the borrower must be obtained and the funds must be verified.

- Funds held jointly with a non-borrowing spouse are considered the Borrower’s funds

Stocks, government bonds, and mutual funds are acceptable sources of funds for the down payment, closing costs, reserves or net eligible assets to determine the total monthly debt calculation provided their value can be verified. Stock options may be an acceptable source of funds, but only for down payment and closing costs. Stock options may not be used in the net assets for qualification purposes or reserves.

Stocks and Mutual Funds When used for down payment or closing costs, Lender must determine the value of the asset (net of any margin accounts) by obtaining either:

- The most recent two months or most recent quarterly statement from the depository investment firm or

- A copy of the stock certificate accompanied by documentation to evidence the stock price as of the application date

- Receipt of funds must be verified to evidence the sale or liquidation with the following exception: If the value of the asset is at least 20% more than the funds needed for the borrower’s down-payment and closing costs, no documentation of liquidation is required

- Non-vested restricted stock is ineligible.

Stock Options

- Vested stock options are an acceptable source of funds for down payment and closing costs if they are immediately available to the borrower. o May not be used for reserves, or for net eligible assets to determine the total monthly debt calculation.

- The value of the vested stock options can be documented by referencing a statement that lists the number of options and the option price AND using the current stock price to determine the gain that would be realized from exercise of an option and the sale of the optioned stock

- Non-vested stock options are not an acceptable source of funds for the down payment, closing costs or reserves. Government Bonds

- The value of government bonds must be based on their purchase price unless the redemption value can be documented.

- When used for reserves, the current value of bonds may be used

Funds disbursed from a borrowers trust account are an acceptable source for the down payment, closing costs and reserves provided the borrower has immediate access to the funds. To document the trust funds:

- Obtain written documentation of the value of the trust account from either the trust manager or the trustee; AND

- Document the conditions under which the borrower has access to the funds and the effect, if any, that the withdrawal of funds will have on the trust income used in qualifying the borrower for the mortgage

Retirement Accounts:

- Vested funds from individual retirement accounts (IRA/Keogh accounts) and tax-favored retirement savings accounts (401(k) accounts) are acceptable sources of funds for down payment, closing costs, reserves and net eligible assets to determine the total monthly debt calculation. Retirement accounts with existing distributions established are not permitted for use as net eligible assets in the loan qualification calculation

- Lender must verify the ownership of the accounts and the borrower's actual receipt of the funds realized from the liquidation of the assets if needed to complete the transaction.

- When funds from retirement accounts are used for reserves or the loan qualification calculation, Lender does not require the funds to be withdrawn from the account(s). However, Lender must exercise caution when considering retirement accounts as effective reserves because these accounts often feature significant penalties for early withdrawals, allow limited access, or have vesting requirements.

- If the retirement assets are in the form of stocks, bonds, or mutual funds, 70% of the current value may be considered when using for reserves with the following exception: If the borrower is not at 59 ½ or older the value of the account should be reduced by 10% to account for an early withdrawal penalty.

- If the retirement account only allows withdrawals in connection with the borrower’s employment termination, retirement (unless the borrower is of retirement age), or death, NPF must not consider the vested funds as effective reserves

Unacceptable Assets:

Anticipated Savings • Bridge Loans • Business funds • Cash-on-hand/Mattress Money • Digital Currency (ex. Bitcoin) • Donated funds in any form, such as cash or bonds donated by the seller, builder or selling agent outside of approved financing contributions in the Seller Concession • Donation from Equities • Employer Assistance • Funds from a Community Second Mortgage/Down Payment Assistance Program • Funds in a Custodial or “In Trust For” account • Gift funds • Gifts from seller-funded programs • Gifts of Equity • Individual Development Accounts (IDAs) • Net proceeds from a reverse 1031 exchange • Personal, unsecured loans • Pooled Funds • Proceeds from a cash-out refinance cannot be used to meet reserve requirements • Rent Credits • Stocks held in an unlisted corporation • Sweat Equity (labor performed by the Borrower or goods or materials provided by the Borrower) • Trade Equity

Cash Reserves:

- For rate and term refinance transactions reserve requirements above are not required for primary and secondary residences that meet the following: Maximum Loan Amount $1,500,000; 0X30X12 on all lates; Housing payment is decreasing on the subject property; Additional properties owned require reserves as outlined below

- Borrowers who own additional real estate must have: Two (2) months of reserves for each additional financed property owned including properties that are pending sale and will not be sold prior to the subject transaction closing. The Principal, Interest, Taxes, Insurance, Association dues (PITIA) is based on each individual property’s respective PITIA.