The HomeStyle Renovation Loan Program

This mortgage product permits borrowers to include financing for home improvements in a purchase or re-finance transaction of an existing home. The HSR mortgage provides a convenient way for borrowers to make renovations, repairs, or improvements totaling up to 50 percent of the as-completed appraised value of the property with a first mortgage, rather than a second mortgage, home equity line of credit, or other, more costly financing method.

Eligible borrowers include individual home buyers, investors, nonprofit organizations, and local government agencies.

Benefits to Borrowers:

- Cost-effective way to renovate or improve a home

- Single mortgage means lower closing costs and typically a lower interest rate on a first mortgage

- Borrowers can qualify for CLTV of up to 105% with eligible Community Seconds® subordinate financing

- Loan amount based on “as-completed” value of the home or the cost basis (purchase money loans), whichever is less

Did you know today’s existing homes are 37 years old on average?

HomeStyle Energy makes it easy for buyers to invest in energy improvements at the time of purchase or refinance.

Fannie Mae’s HomeStyle® Energy helps you offer affordable financing to borrowers interested in improving the energy and water efficiency of their homes. New research reveals that homeowners prefer “features that will help them save energy and keep the home organized.” And, most buyers want homes with energy-efficient windows and highly rated insulation, according to a recent study from the National Association of Home Builders.

Fannie Mae recently made changes to its energy-efficient mortgage loan program to encourage homeowners to make energy-saving enhancements to their homes.

The newly rebranded program – HomeStyle® Energy – provides homeowners opportunities to finance new energy improvements or pay off debt they used to increase the energy or water efficiency of their homes. It also streamlines the process for homeowners who need a small amount of money – up to $3,500 – to weatherize or improve the water efficiency of their homes.

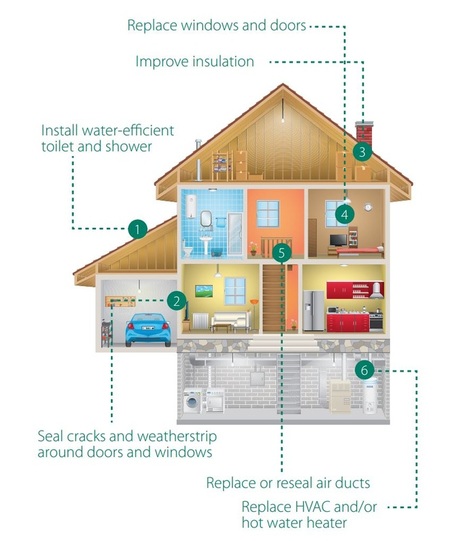

Energy improvements can involve a wide variety of projects – such as adding insulation, energy-efficient windows, or water saving devices. Solar panels and other innovative energy saving devices may also be eligible under HomeStyle Energy.

HomeStyle Energy is available on one- to four-unit principal residences, one-unit second homes, and one-unit investment properties.

HomeStyle Energy makes it easy for buyers to invest in energy improvements at the time of purchase or refinance.

Fannie Mae’s HomeStyle® Energy helps you offer affordable financing to borrowers interested in improving the energy and water efficiency of their homes. New research reveals that homeowners prefer “features that will help them save energy and keep the home organized.” And, most buyers want homes with energy-efficient windows and highly rated insulation, according to a recent study from the National Association of Home Builders.

Fannie Mae recently made changes to its energy-efficient mortgage loan program to encourage homeowners to make energy-saving enhancements to their homes.

The newly rebranded program – HomeStyle® Energy – provides homeowners opportunities to finance new energy improvements or pay off debt they used to increase the energy or water efficiency of their homes. It also streamlines the process for homeowners who need a small amount of money – up to $3,500 – to weatherize or improve the water efficiency of their homes.

Energy improvements can involve a wide variety of projects – such as adding insulation, energy-efficient windows, or water saving devices. Solar panels and other innovative energy saving devices may also be eligible under HomeStyle Energy.

HomeStyle Energy is available on one- to four-unit principal residences, one-unit second homes, and one-unit investment properties.

Simple Options:

Benefits:

- Pay off higher-interest energy improvement debt, including PACE (Property Assessed Clean Energy) loans.

- Finance up to 15% of the as-completed appraised property value of a home.

- Finance up to $3,500 in weatherization or water-efficient improvements with no energy report.

Benefits:

- Help customers reduce their energy costs and improve the comfort of their homes with refinance opportunities.

- Single Family, Second Homes, and even 1-to-4 unit properties eligible.

- Are you buying an older home?

- Are you looking to improve the comfort of your home?

- If you own a home and are considering a refinance transaction, now might be the time to analyze whether or not you are paying too much on energy costs?

WANT TO LEARN MORE ABOUT THESE LOAN PROGRAMS?

TO SET UP AN APPT TO DISCUSS HOW YOU CAN APPLY FOR A HOMESTYLE RENOVATION LOAN...

SIMPLY COMPLETE THE "CONTACT US" INFORMATION FORM BELOW.

ONE OF OUR CERTIFIED MORTGAGE PLANNING EXPERTS WILL CALL OR EMAIL YOU WITHIN ONE BUSINESS DAY.